November 2022

Vol. 25, Issue 11

IRMAA – Or “How Your Medicare

Premiums Are Determined”

You aren’t alone. Many people in higher income brackets come to us shocked and dismayed by seemingly outrageous premiums for what they thought would be very low-cost Medicare coverage.

It is true that for most people, Medicare is heavily taxpayer subsidized. Premiums are designed to be very affordable even for people with very modest retirement incomes.

But the more money you make, the less of a subsidy you receive. At higher income levels, you must pay more and more of the actual cost of providing Medicare Part B and Pard D coverage.

This article is a brief primer on Medicare premiums –– and specifically on IRMAA, or Income-Related Monthly Adjustment Amount.

What Is IRMAA?

In a nutshell, your IRMAA is the amount of Medicare premium you should pay out of pocket, after the Social Security Administration takes your income into account.

Here’s how it works:

If your income is above a certain threshold (for example, because you’ve diligently worked, saved, and invested all your life), the government effectively penalizes you by slapping you with an additional charge, over and above the normal Medicare premium. This provides money to subsidize everyone else – including assistance to very low income individuals.

The extra amount you pay is due to having a high modified adjusted gross income is your IRMAA.

In 2022, if your income was over $91,000, you get tagged for at least another $68 per month in IRMAA for your Part B premiums. And you also had to pay an additional monthly surcharge if you bought a Medicare Part D Plan.

The same will be true next year. Every year, the Social Security Administration updates the income brackets based on inflation, and the premiums based on the actual cost of running Medicare the prior year.

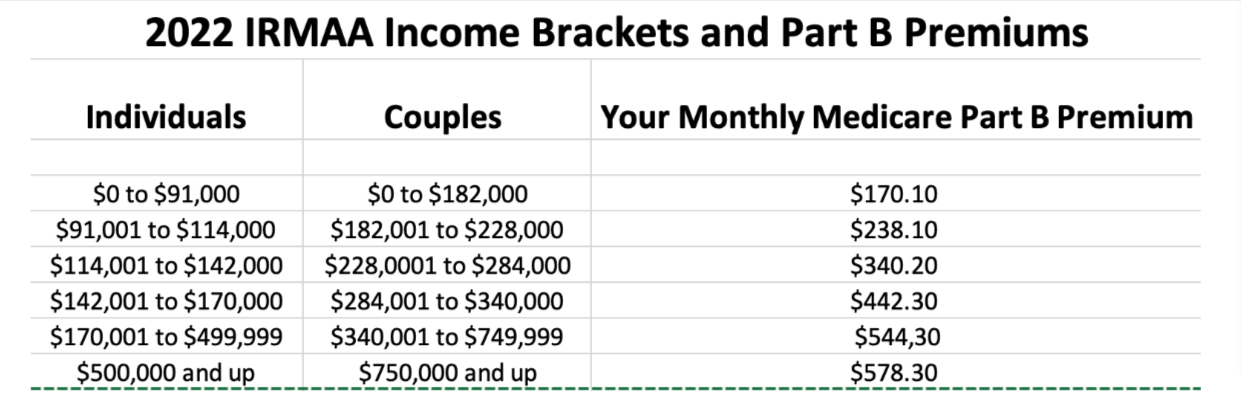

Here’s the breakdown for 2022:

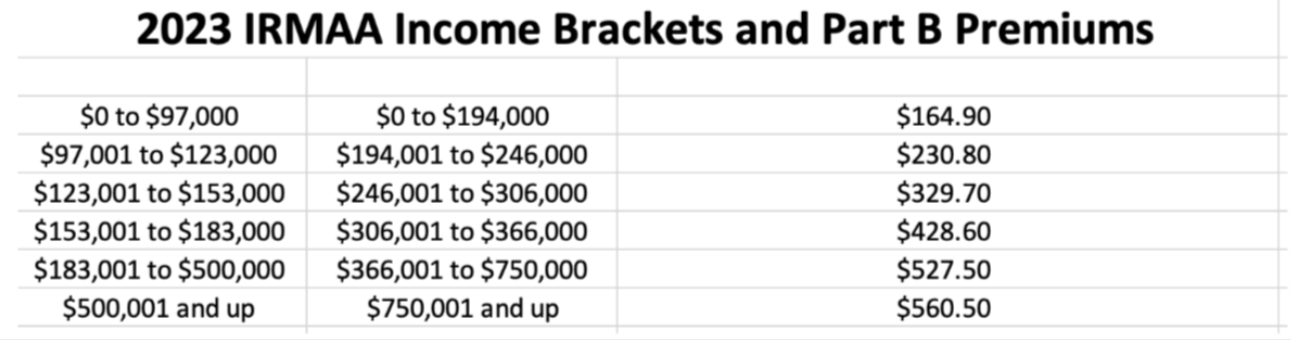

Those amounts have been updated for 2023. Effective January 1st, the new income brackets and premiums are as follows.

A similar table applies to those with Part B for Immunosuppressive drug coverage only. You can see a full breakdown of all the categories at the Center for Medicaid Services page here.

As you can see, the IRMAA adjustments are significant.

The reasoning: Congress has decided that the taxpayer should generally subsidize 75% of the real cost of running Medicare Part B, and beneficiaries should bear 25% of those costs.

So every year, the Social Security Administration takes a look at the actual expenditures under the program, and sets premiums appropriately.

But Congress also decided that those who earn higher incomes don’t need to be subsidized as much, and can afford to pay an amount closer to the real cost of administering Medicare Part B.

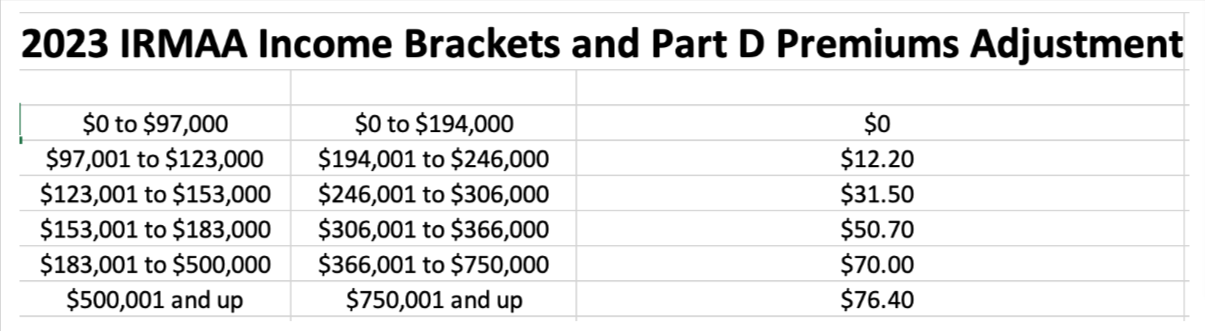

The same holds true for Medicare Part D, which covers prescription drugs.

In this case, the IRMAA amount is an adjustment to your Medicare Part D premiums. So your IRMAA is in addition to your Medicare Part D premium.

For 2023, your Part D IRMAA breakdown is as follows:

IRMAA Appeals and Adjustments

Obviously, sometimes circumstances change. Your income may be much lower this year than in previous years. And the way peoples’ 401(k)s and IRAs have been performing lately, there’s probably going to be a lot of that going around.

Here are the circumstances that may qualify you for an adjusted, lower IRMAA amount:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

Loss or reduction of certain kinds of pension income

To appeal your IRMAA calculation or request an adjustment, you should file a Form SSA-44, using the instructions at the link,

You can reduce your IRMAA with some tax planning techniques.

For example, you can defer income into future years by reducing distributions from retirement accounts (subject to required minimum distributions laws).

The Roth IRA Conversion Strategy

You can also reduce your exposure to IRMAA in future years by judiciously doing Roth IRA conversions. That is, by converting assets in IRAs and other tax-deferred retirement accounts to Roth assets.

You’d have to pay income taxes on amounts you convert. But all future growth in a Roth IRA account is tax-free (provided you leave the money in the account for at least five years). And any amounts you withdraw from your Roth accounts don’t count against you for the purposes of calculating income taxes on Social Security.

And because IRMAA is based on your MAGI, or modified adjusted gross income, distributions from tax free Roth accounts (and withdrawals, loans, and dividends from properly-designed permanent life insurance policies for that matter!) also don’t count against you when calculating your IRMAA.

But make sure you plan ahead!

Don’t overdo your Roth IRA conversions in any one year, or during actual retirement, or in the year before you plan to enroll in Medicare Part B. Otherwise your Roth conversions themselves could accidentally push you into a higher income tax bracket, and a higher IRMAA income bracket – increasing your Part B and Part D premiums instead of reducing them!

HSA For America and Medigap Advisors do not provide tax advice: For information and advice concerning your specific situation, you should seek the services of a qualified tax professional.

We’re here to help!

As always, we’re here to help you make sense of Medicare, and to help you explore all your health care options. Not just the ones Big Pharma and Big Insurance want you to know about.

We’re also here to help you get the best Medicare supplement coverage possible, at premiums you can afford.

If you want to consider changing plans, don’t hesitate to reach out to us.

Just click the calendar link above, of the Personal Benefits Manager that sent you this newsletter,and book an appointment!

To your health and wealth,

Wiley P. Long, III

President – MediGap Advisors